Mountain Commerce Bank (MCB) recognizes the importance of online banking security. MCB will not contact you requesting personal or account information such as account numbers, Social Security numbers, credit or debit card numbers, Online Banking passwords, PINs, or other confidential information. If you receive an unsolicited phone call from (866) 622-1910 requesting any of the above information, please do not respond.

Privacy Policy

Updated March 2024

Your privacy is important to us. MCB is committed to an ongoing review of our policies and procedures in the interest of protecting customer privacy and ensuring the personal information we collect, use and share is protected. The collection, storage and sharing of customer information is an important part of delivering beneficial banking products and services to our customers. This MCB Privacy Policy (“Policy”) describes how we collect and share information when you interact with us online through our website, mobile applications and other online services (“Online Services”) through your computer, smartphone, tablet or other mobile devices.

Our Online Services are intended for a U.S. audience. The terms “MCB,” “we,” “us,” or “our” mean Mountain Commerce Bank. “You” means an individual who visits our Online Services and does not refer to a business entity or other entity or individual outside of the U.S.

By using our Online Services, you agree to the terms and conditions of this Privacy Policy.

MCB works with third-party providers who are contractually obligated to comply with our policies to protect information. However, if you visit or access one of these third-party provider sites or mobile apps, please review the online privacy policies of that site or mobile app to understand the specifics of how your online personal information may be collected, used or shared.

Updates to the Privacy Policy

This Policy is subject to change. We update this Policy periodically to comply with the most recent federal and local laws. Please review it whenever you have questions. If we make changes to this Policy, we will revise the Updated date on this page.

OUR ONLINE PRIVACY PRACTICES

The privacy of customer information is protected not only by state and federal laws, but by our commitment to the protection of financial information. We ask for your consent when required, otherwise by using our Online Services, you consent to the collection, use and sharing of your personal information subject to and consistent with applicable laws, regulations and other notices you may have received based on your relationship with us.

Linking to Other Sites

We may provide links to non-affiliated third-party sites, such as credit bureaus, service providers or merchants. If you follow links to sites not affiliated with, or controlled by MCB, you should review their privacy and security policies and other terms and conditions, as they may be different from those of our Online Services. MCB does not guarantee and is not responsible for the privacy or security of these sites, including the accuracy, completeness or reliability of their information.

Protecting Your Personal Information

To protect personal information from unauthorized access and use, we use security measures that comply with applicable federal and state laws. These measures may include device safeguards and secured files and buildings as well as oversight of our third-party providers to ensure personal information remains confidential and secure. In the event of a data breach,

we provide timely notification, in accordance with applicable laws and regulations. We have established policies and procedures to help prevent misuse of that information. We disclose information permitted or required by a variety of federal and state laws, as required to consummate customer transactions, and as directed by the customer.

Update Your Personal Information

Keeping your personal information accurate and up to date is very important. If your personal information is incomplete, inaccurate or not current, please use the Contact Us option on our Online Services, or call or write to us at the telephone numbers or appropriate address for changes listed on your account statements, records, online or other account materials. You can also speak to a customer representative at a branch or your Relationship Manager.

WHAT PERSONAL INFORMATION DOES MCB COLLECT?

The personal information we collect is limited to what is required to provide our products or services and to support legal and risk requirements.

Types of Personal Information We Collect Online

The type of personal information we collect from and about you online will depend on how you interact with us, and may include:

- Contact information such as name, mailing and physical address, email address, telephone and mobile number(s).

- Account Application information such as credit and income information.

- Personal identifying information such as Social Security number, account number(s), driver’s license number (or comparable) or other information that identifies you for ordinary business purposes.

- Access authorization such as user ID, alias, PIN and password and security questions and answers.

- Documents or images submitted via our website or mobile app to support account opening, such as driver’s license, statements and voided checks.

- Debit/Credit Card Information such as card number, expiration date, CVV2, billing address.

- Information from your computer and mobile devices where allowed by individual browsers and/or operating systems, such as:

- Your Internet Protocol (IP) address or other unique device identifiers (such as Media Access Control (MAC) address)

- Your browser type (such as Google Chrome, Microsoft Edge, Safari), version, language, and display/screen settings

- The presence of any software on your device that may be necessary to view our site

- Configuration information about the device you are using, including, but not limited to, your device type, web browser type and version, operating system type and version, display/screen settings, and language preferences

- Information from your mobile device, such as contacts, photos (for example, to deposit checks or capture receipts), mobile network information, and cross-device IDs

- Information about how you use and interact with our Sites and Mobile Apps (for example, activities on pages visited, links clicked or unique and measurable patterns such as keystrokes, mouse clicks and movements, swipes and gestures)

- Communications data, such as your communication preferences and details or the content of your communications with us (e.g., text messages, chat messages)

- Geolocation information (for example, for real time ATM or branch location)

HOW MCB USES AND SHARES PERSONAL INFORMATION

How Do We Use Your Personal Information?

The personal information we collect from and about you online may be used for numerous purposes such as:

- Delivering products and services to you by verifying your identity (for example when you access your account information); processing applications for products or services such to open a deposit account; processing transactions; providing customer service/production support; and finding nearby ATMs, financial centers, and other specialized location based services near your location.

- Personalizing your digital and mobile experience by enhancing the user experience to create relevant alerts, products or services.

- Detecting and preventing fraud, identify theft and other risks to you or MCB.

- Performing analytics concerning your use of our online services, including your responses to our emails and the pages you view.

- Complying with regulatory requirements and enforcing applicable legal requirements, contractual obligations and our policies.

- Allowing you to use features within our Online Services when you grant us access to personal information from your device, such as contact lists, or geo-location when you request certain services that require such access, for example locating an ATM.

- Providing notifications and communications regarding the Online Services.

We retain personal information as required by federal and state laws and regulations and the necessary business purpose.

How Do We Share Your Personal Information?

MCB may share the personal information we collect from and about you in different ways as permitted and required by law. For example, we may share your information with:

- Third-party providers with which we contract to offer products and services for our customers, such as bill pay and credit cards.

- Third-party service providers that provide various services to us, such as those that help us process transactions, maintain accounts, detect and prevent fraud and improve our Online Services.

- Credit reporting agencies to report on or learn about your financial circumstances and as permitted by law.

- Government agencies as required by laws and regulations for purposes such as:

- Responding to requests from bank regulators

- Responding to a warrant, subpoena, governmental audit or investigation, law enforcement request, legal order or other legal process

- To exercise or defend legal claims

OTHER IMPORTANT NOTICES

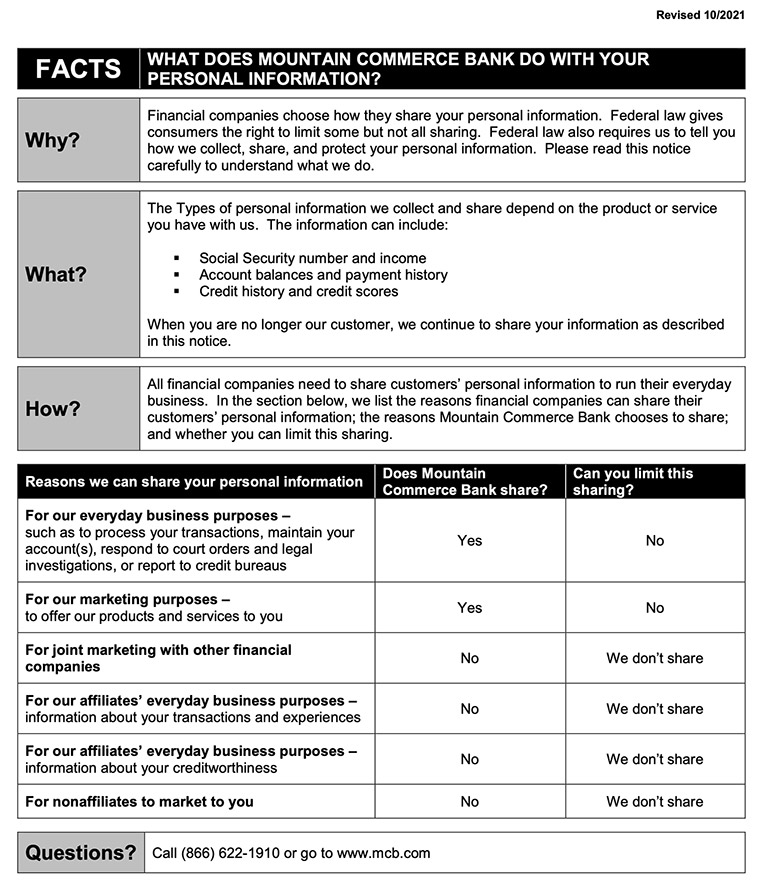

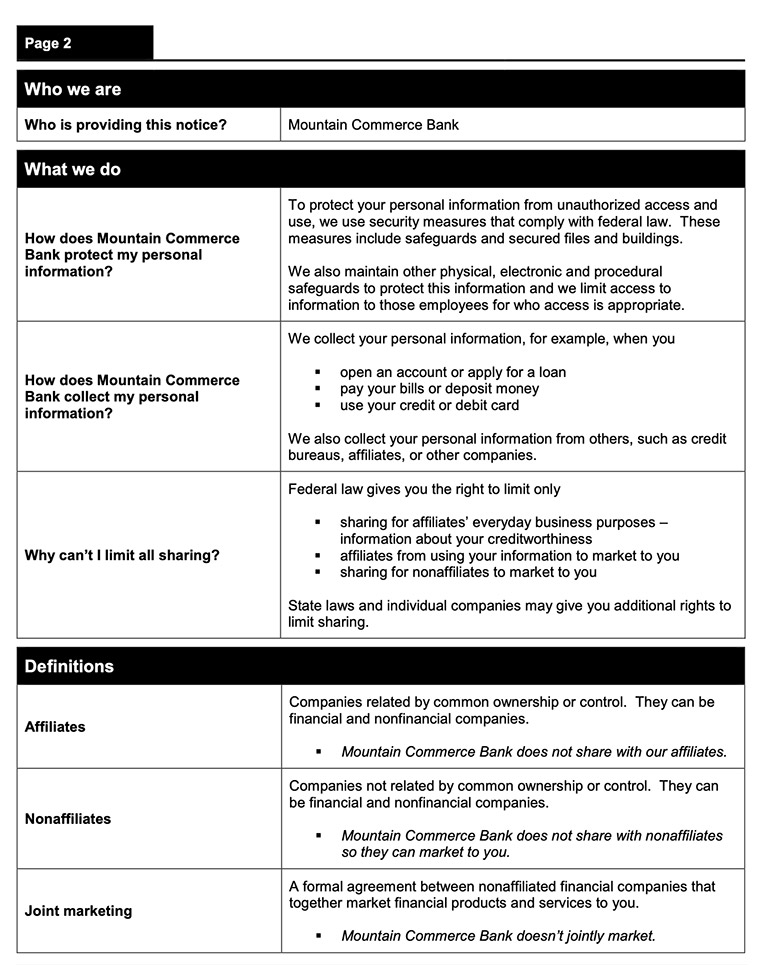

Our Privacy Notice applies to information that we collect about individuals who seek, apply for or obtain our financial products and services for personal, family or household purposes. You can find our notice here.

Identity Theft & Fraud

Frequently Asked Questions (FAQs)

Identity theft occurs when someone uses your personal information without permission and in order to commit fraud. Your personal information may include Social Security number, birth date, mother’s maiden name, passport information, and additional information that is not readily available for public use. In this case, your personal information would be used to impersonate a victim with the intent to commit fraud.

- Identity theft can occur from a number of sources. Your personal information may be taken from:

- Stealing your wallet, purse, or checkbook

- Phishing or obtaining your information through email scams or fraudulent websites

- Illegally gaining access to a computer where personal information is stored

- Removing mail from your mailbox or going through your trash to find receipts or statements

- Other scams aimed to gather your personal information

You should regularly monitor your accounts and financial statements to identify any discrepancies and check your credit report on a regular basis. You may learn that your identity has been stolen if you begin to have problems with your credit history when you apply for a loan, if collection agencies contact you for overdue debts, or if you receive notifications about a job or property you have never had.

You should immediately contact the credit reporting agencies, law enforcement, and your financial institutions to notify them of the identity theft. More information about the identity theft alert and recovering process can be found on the Federal Trade Commission website.

Phishing is the fraudulent act of emailing a consumer in attempt to gather private information by claiming to be an established business. The email will direct the recipient to a false website where they are asked to update person information like passwords, account numbers, Social Security numbers and other private information. The purpose of phishing is for identity theft and unauthorized account activity.

Mountain Commerce Bank will never request that you supply your personal information by email or over the Internet. We obtained all of the necessary information from you when your account was established. We have no reason to request this information from you after the account establishment. You may have been targeted as part of a phishing scheme. Do not respond to the inquiry and contact your nearest branch location.

Security Tips

- Protect your information. Never give your Social Security number or personal credit information over the phone or the Internet unless you initiate the communication. Keep your personal identification number (PIN) and password in a safe place. Try to memorize your PIN and password and do not write them down with your account information.

- Destroy and/or securely store your account records. Tear or shred receipts, bank statements and unused credit card offers. Keep billing statements and other account related documents in a safe place.

- Immediately report lost or stolen checks, credit cards, and ATM or debit cards.

- Memorize your personal identification numbers—Do not carry them in your wallet.

- Promptly review all monthly financial statements and immediately report any discrepancies.

- Retain receipts from all ATM, debit and credit card transactions. When you are ready to dispose of them, make sure your account number is not readable.

- Immediately sign new credit cards.

- Report unusual telephone or e-mail inquiries or other suspicious activity to your telephone company or local law enforcement authorities.

- Online Privacy Protection Act (COPPA) and follow the tips for parents at the Federal Trade Commission’s web site for children’s privacy at Children’s Online Privacy Protection Rule (“COPPA”) We respect the privacy of your children, and we comply with the COPPA. We do not knowingly collect or retain personally identifiable information from individuals under the age of thirteen online.

- Regularly review your credit report. Keeping your credit report error free is important. Order a copy of your credit report and report any mistakes to the credit bureau and the creditor reporting the information. See www.ftc.gov for more information on how to request one free credit report per year from each credit bureau. The three national credit bureau agencies are: Equifax – www.equifax.com 1-800-685-1111, Experian – www.experian.com – 1-888-397- 3742, and TransUnion – www.transunion.com 1-800-916-8800

- Check your billing statements. Review your statements thoroughly. Contact all your creditors immediately if you notice incorrect transactions.

- If you lose your credit card or suspect that you have been a victim of identity theft, immediately notify your creditors, local law enforcement and the credit bureau agencies listed above. If you think your identity has been stolen, you may want to visit http://www.consumer.gov/idtheft, sponsored by the Federal Trade Commission.

- Update your personal information as necessary by calling us using the customer service number on your account statement or contacting your local Mountain Commerce Bank banking branch.