Mountain Commerce Bank (MCB) recognizes the importance of online banking security. MCB will not contact you requesting personal or account information such as account numbers, Social Security numbers, credit or debit card numbers, Online Banking passwords, PINs, or other confidential information. If you receive an unsolicited phone call from (866) 622-1910 requesting any of the above information, please do not respond.

Download the 2022 Annual Report PDF here

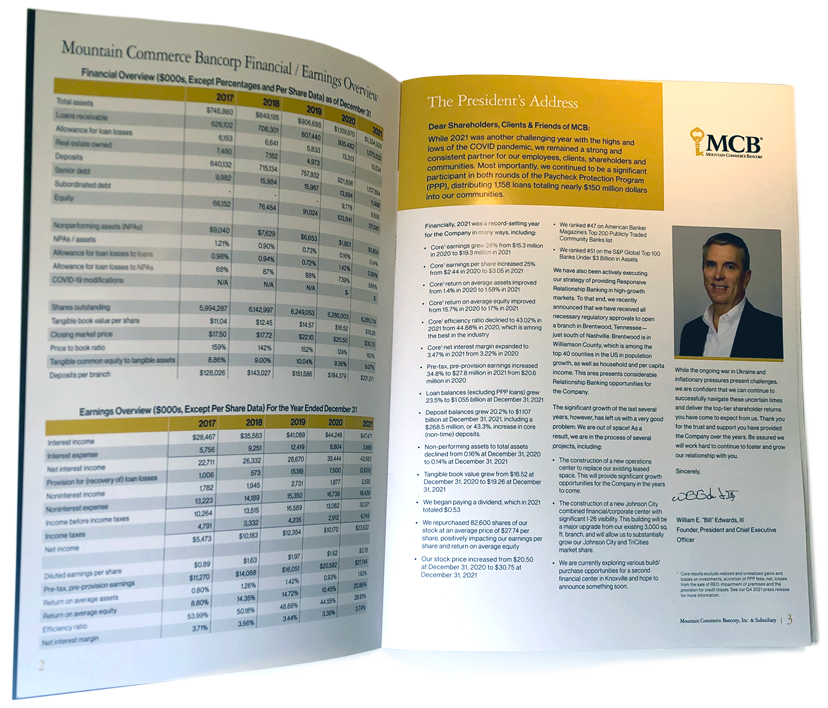

Click the image below to view full page version of the annual report

2022 Annual Report Released

Dear Shareholders, Clients & Friends of MCB:

2022 was another challenging year for the banking industry as the Federal Reserve battled persistently high levels of inflation with a 425 bp rise in short-term interest rates. Although this historic increase in interest rates presented many challenges for both the value of our assets as well as our funding costs, we remain a strong and consistent partner for our clients, shareholders, employees, and communities.

Selected financial highlights from 2022 included the following:

2022 was also a year of significant physical expansion for the Bank as we continued to work on the following projects:

While the ongoing war in Ukraine, inflationary and funding pressures, and a looming possible recession present concerns, we are confident we can continue to successfully navigate these uncertain times and deliver the shareholder returns you have come to expect from us. Thank you for the trust, patience and support you have provided the Company over the years.

Sincerely,

![]()

William E. “Bill” Edwards, III

Founder, President and Chief Executive Officer

1 Core results (which are non-GAAP financial measures) reflect adjustments for realized and unrealized investment gains and losses, PPP fee accretion (net of the amortization of PPP deferred loan costs and one-time PPP bonuses), gains and losses from the sale of REO, the provision for (recovery of) loan losses, the provision for (recovery of) unfunded loan commitments, and the impact of a fraudulent wire loss incurred in the second quarter of 2022. See our Q4 2022 press release for more information.