Mountain Commerce Bank (MCB) recognizes the importance of online banking security. MCB will not contact you requesting personal or account information such as account numbers, Social Security numbers, credit or debit card numbers, Online Banking passwords, PINs, or other confidential information. If you receive an unsolicited phone call from (866) 622-1910 requesting any of the above information, please do not respond.

Download the 2021 Annual Report PDF here

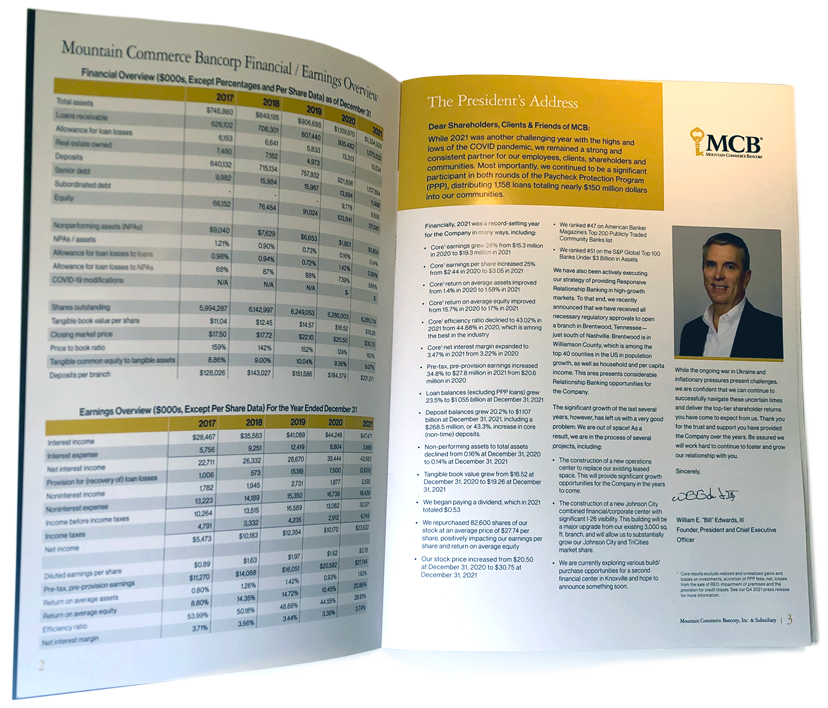

Click the image below to view full page version of the annual report

2021 Annual Report Released

Dear Shareholders, Clients & Friends of MCB:

While 2021 was another challenging year with the highs and lows of the COVID pandemic, we remained a strong and consistent partner for our employees, clients, shareholders and communities. Most importantly, we continued to be a significant participant in both rounds of the Paycheck Protection Program (PPP), distributing 1,158 loans totaling nearly $150 million dollars into our communities.

Financially, 2021 was a record-setting year for the Company in many ways, including:

We have also been actively executing our strategy of providing Responsive Relationship Banking in high-growth markets. To that end, we recently announced that we have received all necessary regulatory approvals to open a branch in Brentwood, Tennessee—just south of Nashville. Brentwood is in Williamson County, which is among the top 40 counties in the US in population growth, as well as household and per capita income. This area presents considerable Relationship Banking opportunities for

the Company.

The significant growth of the last several years, however, has left us with a very good problem: We are out of space! As a result, we are in the process of several projects, including:

While the ongoing war in Ukraine and inflationary pressures present challenges, we are confident that we can continue to successfully navigate these uncertain times and deliver the top-tier shareholder returns you have come to expect from us. Thank you for the trust and support you have provided the Company over the years. Be assured we will work hard to continue to foster and grow our relationship with you.

Sincerely,

![]()

William E. “Bill” Edwards, III

Founder, President and Chief Executive Officer

1 Core results exclude realized and unrealized gains and losses on investments, accretion of PPP fees, net, losses from the sale of REO, impairment of premises and the provision for credit losses. See our Q4 2021 press release